Create a new business account, set budget aside for tax, keep your records organised and leave an audit trail. This blog will highlight even more useful bookkeeping tips and terms that you should be aware of. Individuals who are successful bookkeeping professionals are highly organized, can balance ledgers accurately, have an eye for detail and are excellent communicators. Small businesses often work with tax advisors to help prepare their tax returns, file them and make sure they’re taking advantage of small-business tax deductions. Though you may not work regularly with a tax specialist year-round, you’ll want to connect with one sooner rather than later so you’re not rushed come tax time. Our small business tax professional certification is awarded by Block Advisors, a part of H&R Block, based upon successful completion of proprietary training.

It replaces the time-consuming method of collecting receipts in a drawer and manually tracking revenue and expenses in a spreadsheet or with pen and paper. Wave’s optional paid features include online payment processing, payroll software, and access to personalized bookkeeping services and coaching through Wave Advisors. If you’re interested in using payroll software, you can start a free 30-day trial when you sign up for Wave. At the very least, you’ll want to track expenses and income in a secure cloud-based platform.

Handle accounts receivable and payable

The general ledger notates the account number to which the debit or credit is applied. The best accounting software automates a lot of the process in journal entries for regular debits and credits to help eliminate possible errors in data entry. Generally speaking, bookkeepers help collect and organize data and may have certain certifications to do so for your business. On the other hand, accountants are generally equipped with an accounting degree and may even be state-certified CPAs. You can expect most bookkeepers to maintain the general ledger and accounts while the accountant is there to create and interpret more complex financial statements. If you want to save time and money, using accounting software for your small business is the right choice.

It’s a crucial step that lets you monitor the growth of your business, build financial statements, keep track of deductible expenses, prepare tax returns, and legitimize your filings. Small-business accounting is a set of financial activities for the processing, measurement, and communication of a business’s finances. These activities include taxes, management, payroll, acquisition, and inventory.

Ready for tax filing

The Bookkeeping feature makes life easy once you know how it works – so, ears open. The first is ‘Incoming’ – for your revenue, refunds, loans, rebates and so on. Then there’s ‘Outgoing’, which includes things like expenses and tax payments. Bookkeeping not only tells you what additional information Business bookkeeping you need to record on transactions, but it also helps you to record it more easily – in a matter of clicks. If you don’t connect any bank accounts, the Inbox will remain empty. Just released in the spring of 2020, Kashoo 2.0 includes a completely updated user interface that looks sparkling new.

Since good record keeping relies on accurate expense tracking, it’s important to monitor all transactions, keep receipts, and watch business credit card activity. Many bookkeeping software options automate the tracking process to eliminate errors. Using the data you gain from keeping a ledger, your next step will be to generate and prepare financial reports for analysis.

Ecommerce platforms and bookkeeping

Bookkeepers often allow you to choose different service levels depending on your budget. That means you can start out with basic bookkeeping at a modest cost and ladder up to more advanced services as your business grows. A small business can likely do all its own bookkeeping using accounting software. Many of the operations are automated in the software, making it easy to get accurate debits and credits entered. As a business owner, it is important to understand your company’s financial health. Bookkeeping puts all the information in so that you can extract the necessary information to make decisions about hiring, marketing and growth.

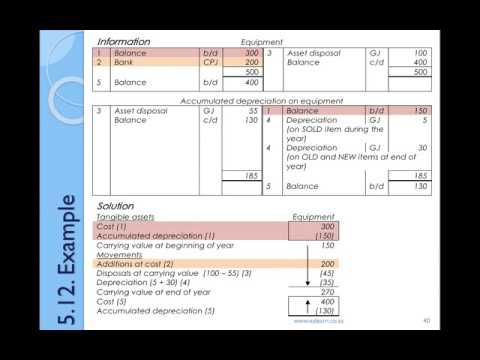

Double-entry accounting enters every transaction twice as both a debit and a credit. Your business’s books are balanced when all of the debits equal (or cancel out) all of the credits. And since it takes equity, assets and liabilities — on top of expenses and income — into account, it typically gives you a more accurate financial snapshot of your business. For example, some small business owners do their own bookkeeping on software their accountant recommends or uses, providing it to the accountant on a weekly, monthly or quarterly basis for action. Other small businesses hire a bookkeeper or employ a small accounting department with data entry clerks reporting to the bookkeeper. Check out our reviews of the best accounting software for small businesses so you can create invoices, record payments, collect receivables and run reports that help you manage your financial health.

What does the Bookkeeping feature do?

Bookkeeping is essential to the vitality and long-term success of any small business. Primarily, you need to have an accurate picture of all the financial ins and outs of your business. From the cash you have on hand to the debts you owe, understanding the state of your business’s finances means you can make better decisions and plan for the future. Using a spreadsheet is the cheapest option, especially if you use Google Sheets rather than Microsoft Excel, which costs a monthly fee. However, general ledgers can get complicated if you’re trying to juggle multiple accounts.

- In the accounting software, the primary journal entry for total payroll is a debit to the compensation account and credits cash.

- You can also join your QuickBooks Community, an online hub for QuickBooks answers and connecting with other QuickBooks users all over the world.

- Instead of tossing that receipt on your desk for later, it’s time to start accounting for it properly.

- They must take 24 hours of continuing education each year to maintain their license.

Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. Get a direct line to your team on desktop or mobile—professional support is just a few swipes, taps, or clicks away. Along with invoicing, Sage Business Cloud Accounting allows you to create quotes and estimates, add credit notes to any customer account, and even post a batch of quick entries. If you’re ready to get started, there are a few things you’ll need to do.

See our step-by-step guide on how to import bookkeeping data into Wave here. Wave is PCI Level-1 certified for handling credit card and bank account information. After creating your account, everything’s set up so you can get started right away. Your data is always available, and it’s backed up for extra peace of mind. Transactions will appear in your bookkeeping automatically, and you can say goodbye manual receipt entry.

- This timesheet template includes break time, regular and overtime hours, sick days, vacation time, and holidays.

- This payroll register template includes a pay stub and a register of employee information to help you process payroll.

- When this is done in the accounting software, the invoice is created, and a journal entry is made, debiting the cash or accounts receivable account while crediting the sales account.

- Whether it’s Shopify, BigCommerce, WooCommerce, or Adobe Commerce, you must keep track of income, outgoings, and any relevant taxes.

Block Advisors does your bookkeeping for you, freeing up your time to focus on what you love. With us, you get a dedicated Account Manager who knows you and your business. Bookkeeping is the process of categorizing all your income and expenses into a clear reporting structure. Your financial records represent the core of your business, and if they’re not maintained thoroughly and daily, your small business can feel the effects.

And sometimes it can be produced to include comparisons against the prior year’s same period or the prior year’s year-to-period data. For both sales and purchases, it’s vital to have detailed, complete records of all transactions. You’ll need to note the amount, the date, and any other important details to ensure you can accurately summarize your finances when it comes time for tax season. Purchase receipts should always be kept as proof that the purchases took place. When hiring external team members, keep in mind that some of the responsibility still falls to you as the proprietor.

Making businesses better: Whether it’s bookkeeping or strategy … – ROI-NJ.com

Making businesses better: Whether it’s bookkeeping or strategy ….

Posted: Mon, 24 Jul 2023 07:00:00 GMT [source]

You can also generate reports such as accounts receivable, balance sheets, sales tax reports, and accounts payable. There’s good news for business owners who want to simplify doing their books. Business owners who don’t want the burden of data entry can hire an online bookkeeping service. These services are a cost-effective way to tackle the day-to-day bookkeeping so that business owners can focus on what they do best, operating the business. For business owners who don’t mind doing the data entry, accounting software helps to simplify the process. You no longer need to worry about entering the double-entry data into two accounts.

Sure, most accounting software platforms come with some form of support, but it’s generally technical support for troubleshooting software-specific programs. You want a solution backed not only by technical experts but also by real-world accounting and bookkeeping professionals to help ensure your books are accurate at all times. The world has become electronic and internet-based, and this is especially true for accounting and bookkeeping support. But if you use software on your own to manage your books, you don’t have an experienced set of eyes reviewing your work.

Businesses also need to pay bills and invoices on time, known as accounts payable. Strong accounts receivable and accounts payable management are critical to managing the business to ensure an uninterrupted flow of capital both in and out of the company. Profit and loss statements highlight the revenues, costs, and expenses your business incurred during a set period, while a balance sheet shows your assets and liabilities at any given moment in time.